With two attractive long-term immigration programs the PVIP and MM2H, Malaysia is quickly becoming a hotspot for international investors, business owners, and expats from around the world.

The Malaysian Premium Visa Programme (PVIP) is a residence-by-investment scheme that grants a multiple-entry stay valid for up to 20 years. It allows eligible applicants to live, work, and study in Malaysia, while also providing benefits to their dependents.

Along with the PVIP, the Malaysia My Second Home (MM2H) Programme is another long term option, however, this immigration program is focused on retirees, long-term residents and those who don’t plan to work in Malaysia.

One of the key advantages of the MM2H programme is that it offers long-term residency with benefits such as family support, education access, and offshore income tax exemptions, but does not allow holders to work or study in Malaysia. However, exceptions apply for children who may undertake education; and the “Platinum” category permits the holders to engage in work or business.

In this guide comparing PVIP vs MM2H, we will explore both programmes in detail, highlighting their key features, advantages, and limitations to help you make an informed decision about which option aligns best with your lifestyle and long-term goals. Whether you’re considering Malaysia as second home for retirement, investment, or a new lifestyle, understanding the differences between these two programmes is essential.

What Are the PVIP and MM2H Immigration Programs in Malaysia?

Both the Premium Visa Programme (PVIP) and Malaysia My Second Home (MM2H) offer long term residency opportunities in Malaysia, however, each programme is designed for different groups of applicants and is subject to its own set of eligibility criteria and application requirements.

The Malaysia PVIP (Premium Visa Programme)

The Premium Visa Programme (PVIP) has been designed to attract affluent investors and business professionals who are looking for long-term residency in Malaysia or Asia.

Applicants must satisfy strict financial requirements, including a minimum offshore income of RM 40,000 (approximately USD 9,000) per month and a RM 1 million (approximately USD 227,000) fixed deposit in a licensed Malaysian bank.

Malaysia My Second Home (MM2H)

The Malaysia My Second Home Programme (“MM2H”) differs from the PVIP as it does not permit work or study in Malaysia. However, this is subject to exceptions for children who may undertake education; and holders of the “Platinum” category who may engage in work or business.

This makes it more suitable for retirees, digital nomads and those who wish to stay long term in Malaysia.

Another key difference to the PVIP program is that the MM2H is available in four different tiers (Silver, Gold, Platinum, and the Special Economic Zone (SEZ)), each with its own financial requirements and periods of program validity (ranging from 5 to 20 years).

Financial and Eligibility Requirements

While both immigration programs offer long term residency options for the holder, it is important to note that each program has its own set of unique eligibility and financial requirements.

The Malaysia Premium Visa Programme (PVIP) Eligibility Requirements

The Malaysia Premium Visa Programme (PVIP) is open to applicants of all ages and is designed for individuals who can meet specific financial and documentation requirements.

To qualify, applicants must be able to show a minimum offshore income of RM 40,000 per month or RM 480,000 annually, which is approximately USD 8,400 per month or USD 101,000 per year. Additionally, they must make a fixed deposit of RM 1 million (approximately USD 210,000) in a licensed Malaysian bank. After keeping this deposit in the account for one year, up to 50% of the amount may be withdrawn for approved purposes such as purchasing real estate, paying for education, or covering medical expenses.

There are also other costs with the PVIP that must be considered, including an annual pass fee of RM 2,000 (approximately USD 420). The main applicant must also pay a one-time participant fee of RM 200,000 (approximately USD 42,000), while each dependent is subject to a fee of RM 100,000 (approximately USD 21,000).

More Information about the PVIP Programme

Malaysia My Second Home (MM2H) Eligibility Requirements

To apply for the Malaysia My Second Home (MM2H) programme, applicants must be at least 25 years old for the Silver, Gold, and Platinum tiers, while those applying under the Special Economic Zone (SEZ) tier must be at least 21 years old. Applicants must also be citizens of countries that maintain diplomatic relations with Malaysia.

The MM2H programme is offered through four different tiers, each with its own set of financial requirements, permitted activities, and durations of stay:

Silver Tier:

Applicants must place a fixed deposit of at least USD 150,000 (approximately RM 712,500) in a Malaysian bank and invest a minimum of RM 600,000 (approximately USD 126,000) in property. Up to 50% of the deposit may be withdrawn for approved expenses.

The programme is valid for 5 years and is renewable. Work or business activities are not permitted under this tier.

Gold Tier:

This tier requires a minimum fixed deposit of USD 500,000 (approximately RM 2.37 million) and a property investment of at least RM 1 million (approximately USD 210,000). Like the Silver Tier, up to 50% of the fixed deposit may be withdrawn for approved purposes.

The Gold Tier offers a 15-year renewable visa, and participants are not permitted to engage in work or business.

Platinum Tier:

Applicants must place a minimum of USD 1 million (approximately RM 4.75 million) in a Malaysian bank and invest at least RM 2 million (approximately USD 420,000) in real estate. They may also withdraw up to 50% of the deposit after one year for approved uses. The programme duration is 20 years and renewable. Work and business activities are allowed.

Special Economic Zone (SEZ) Tier:

This tier has a lower financial threshold, requiring a fixed deposit of USD 32,000 to USD 65,000 (approximately RM 152,000 to RM 308,000), depending on the specific SEZ. Property investment requirements are subject to the regulations of the individual state within the SEZ.

As with the other tiers, up to 50% of the fixed deposit may be withdrawn for approved expenses. The programme is valid for 10 years and is renewable. However, participants under the SEZ tier are not permitted to work or engage in business.

After receiving approval, a medical check-up is mandatory, and applicants must also obtain valid medical or health insurance coverage in Malaysia. In addition, all successful applicants must purchase a property in Malaysia after receiving MM2H approval to fulfill the programme’s real estate requirement.

More information about the MM2H programme

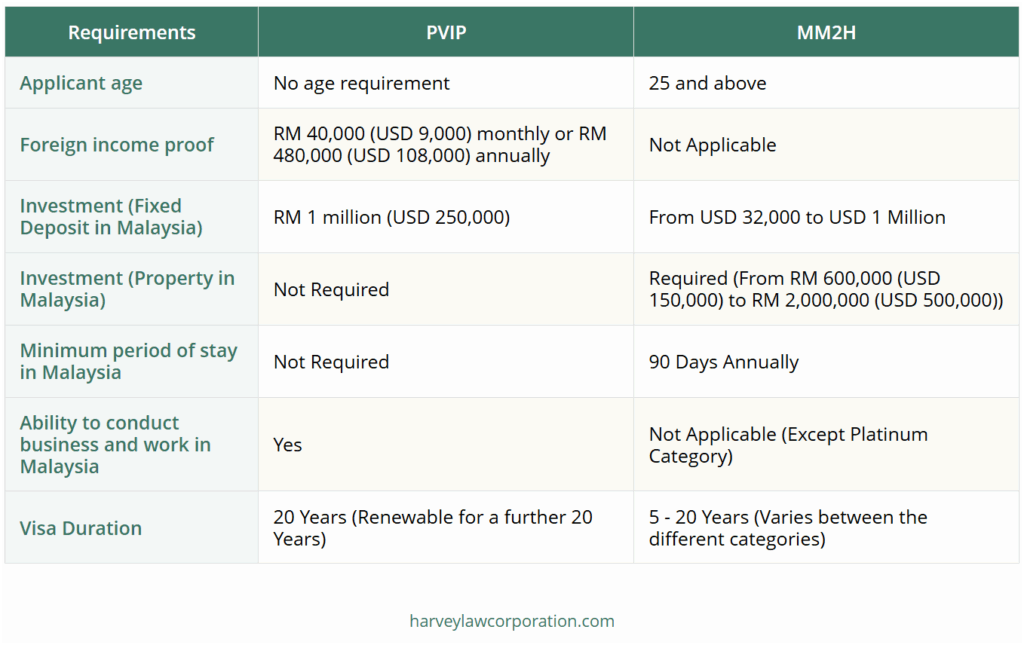

MM2H and PVIP Comparison

What are the Strengths and Weaknesses of Each Option?

Both the PVIP and MM2H are attractive options for foreign nationals who are looking to relocate to Malaysia, however both have strengths and weaknesses that should be considered.

Premium Visa Programme (PVIP) Pros and Cons

Unlike the MM2H programme, the PVIP offers both residency, and the right to engage in business, work, and investment activities.

Key Benefits of the PVIP

One of the PVIP’s main features is its long-term 20-year renewable stay with no minimum stay requirement. The programme is available to applicants of any age, making it suitable for a wider range of applicants including from young entrepreneurs, digital nomads and foreign investors.

Holders of the PVIP are also able to:

- Work or find employment in Malaysia

- Engage in business activities in Malaysia

- Complete education or academic opportunities such as studying at university.

PVIP holders can also bring along their spouse, children, parents, and foreign domestic helpers.

Weaknesses of the PVIP

The PVIP requires significant upfront costs, including a RM 200,000 (approx. USD 42,000) participation fee for the main applicant. Applicants must also be able to satisfy strict financial requirements, such as proof of RM 40,000 (approx. USD 9,000) in monthly offshore income and be able to make a RM 1 million (approx. USD 225,000) fixed deposit in a Malaysian bank.

Malaysia My Second Home (MM2H) Pros and Cons

The Malaysia My Second Home (MM2H) programme offers lower entry barriers than the Premium Visa Programme (PVIP) and is particularly attractive for those who wish to bring their family to Malaysia.

Key Advantages of MM2H

The MM2H is a family friendly immigration program that has different options for being able to support dependents. Eligible dependents include, spouses, children (biological, adopted, or stepchildren), and parents or parents-in-law.

For holders of Platinum Tier, there is also the ability to bring a maid.

The MM2H also offers the following benefits:

- A minimum stay requirement of just 90 days per year, providing flexibility for frequent travelers.

- No mandatory requirement for proof of offshore income, unlike the PVIP.

- Tax exemptions on all offshore income remitted to Malaysia.

Weaknesses of the MM2H

While MM2H offers many advantages, there are some weaknesses that interested applicants should consider.

Depending on the category held, the duration of the MM2H is shorter (5 years for Silver, 10 years for SEZ and 15 years for Gold) when compared to the 20-year PVIP.

Furthermore, the ability to work, undertake any form of business, or investment activities is limited or restricted under the Silver, Gold and SEZ tiers.

PVIP vs MM2H – Which is the Right Choice for you?

Deciding between the Premium Visa Programme (PVIP) and the Malaysia My Second Home (MM2H) ultimately depends on your lifestyle preferences, financial situation, and whether you intend to work or conduct business in Malaysia.

The PVIP is aimed at entrepreneurs, business owners, and high-net-worth individuals who are looking to invest, work, or establish a business in Malaysia. With a 20-year renewable stay, no age restrictions, and the ability to engage in employment or business activities, it is the most suitable option.

Whereas, the MM2H programme is better suited for retirees, digital nomads, or expats with passive offshore income. The MM2H has lower financial requirements to qualify, the ability to include dependents, and attractive tax exemptions on offshore income.

While certain tiers of the MM2H does not allow the holder to work or engage in business, it provides an excellent opportunity for those with a family who are looking for a long-term residency solution.

Read Also: Retire in malaysia: A Comprehensive Guide US Retirees

Conclusion

Both the Premium Visa Programme (PVIP) and the Malaysia My Second Home (MM2H) provide excellent pathways to obtain a Malaysia residence permit, but they are designed for very different types of applicants.

The PVIP is a good choice for entrepreneurs and high-net-worth individuals seeking business flexibility, while the MM2H programme is better suited for retirees, remote workers, or families focusing on their lifestyle.

Before moving to Malaysia and applying for either immigration program, it is important for applicants to take the time to fully assess their financial situation, professional and career plans, and long-term goals. Whether you’re looking to launch a business venture or settle into a relaxed tropical lifestyle, choosing the right program is an important step if you are considering long-term residency in Malaysia.

FAQ About PVIP and MM2H

What is the difference between PVIP and MM2H Malaysia immigration programs?

The PVIP (Premium Visa Programme) allows holders to work, study, and conduct business in Malaysia with a 20-year renewable visa, while MM2H (Malaysia My Second Home) primarily focuses on residency without work rights (except Platinum tier). PVIP requires higher financial commitments including RM 1 million fixed deposit and RM 40,000 monthly offshore income, whereas MM2H offers multiple tiers starting from USD 32,000 deposit in the SEZ category. Harvey Law Group’s experienced immigration attorneys can help you determine which program aligns with your specific goals and financial situation.

Can I live in Malaysia as a US citizen through PVIP or MM2H?

Yes, US citizens can live in Malaysia through both PVIP and MM2H programs since both are open to foreign nationals from countries with diplomatic relations with Malaysia. The PVIP offers a 20-year renewable stay with work rights, while MM2H provides 5-20 year options depending on the tier chosen. Both programs allow you to bring dependents including spouse, children, and parents. Harvey Law Group specializes in helping US citizens navigate Malaysia’s immigration requirements and ensure successful applications.

How much money do I need for PVIP vs MM2H Malaysia programs?

PVIP requires RM 1 million (USD 210,000) fixed deposit plus RM 200,000 participation fee and proof of RM 40,000 monthly offshore income. MM2H costs vary by tier: Silver requires USD 150,000 deposit, Gold needs USD 500,000, Platinum demands USD 1 million, while SEZ starts at just USD 32,000. All tiers also require property investments ranging from RM 600,000 to RM 2 million. Harvey Law Group’s financial planning expertise ensures you meet all requirements efficiently and cost-effectively.

Which Malaysia visa allows me to work – PVIP or MM2H?

PVIP allows full work and business rights in Malaysia without restrictions, making it ideal for entrepreneurs and professionals. MM2H generally prohibits work except for the Platinum tier (USD 1 million investment) which permits work and business activities. Silver, Gold, and SEZ tiers of MM2H do not allow employment or business operations. Harvey Law Group’s business immigration specialists can guide you through PVIP applications if work authorization is your priority.

What are the age requirements for PVIP vs MM2H Malaysia programs?

PVIP has no age restrictions and welcomes applicants of any age, making it suitable for young entrepreneurs and digital nomads. MM2H requires applicants to be at least 25 years old for Silver, Gold, and Platinum tiers, while the SEZ tier accepts applicants from 21 years old. Both programs allow inclusion of dependents regardless of the main applicant’s age. Harvey Law Group has successfully helped clients of all ages secure Malaysian residency through both programs.

How long can I stay in Malaysia with PVIP vs MM2H visas?

PVIP provides the longest stay option with a 20-year renewable visa and no minimum stay requirement, offering maximum flexibility. MM2H durations vary: Silver offers 5 years, SEZ provides 10 years, Gold grants 15 years, and Platinum extends to 20 years, all renewable. MM2H requires a minimum 90-day annual stay in Malaysia. Harvey Law Group’s renewal support services ensure your visa remains valid throughout your Malaysian residency journey.

Can I bring my family to Malaysia under PVIP or MM2H programs?

Both PVIP and MM2H are family-friendly programs allowing dependents including spouse, children, and parents. PVIP permits foreign domestic helpers, while MM2H Platinum tier specifically allows maids. MM2H is particularly attractive for families due to lower financial barriers in Silver and SEZ tiers, plus tax exemptions on offshore income for family finances. Harvey Law Group’s family immigration expertise ensures all your dependents are properly included in your application.

Do PVIP and MM2H holders pay taxes on foreign income in Malaysia?

MM2H holders enjoy complete tax exemptions on all offshore income remitted to Malaysia, making it highly attractive for retirees and those with passive foreign income. PVIP tax treatment isn’t specifically detailed in the program benefits, but the higher financial requirements suggest different tax implications. Professional tax advice is essential for both programs to optimize your financial planning. Harvey Law Group’s tax planning specialists work with international tax experts to structure your finances optimally.

Which is better for retirement – PVIP or MM2H Malaysia program?

MM2H is specifically designed for retirees and offers better value with lower financial requirements, tax exemptions on offshore income, and family inclusion benefits. The Silver tier (USD 150,000 deposit) or SEZ tier (USD 32,000 deposit) provide affordable retirement options. PVIP’s higher costs and work focus make it less suitable unless you plan business activities during retirement. Harvey Law Group’s retirement immigration services have helped hundreds of retirees achieve their Malaysian lifestyle goals.

What property investment is required for PVIP vs MM2H Malaysia?

PVIP allows using up to 50% of the RM 1 million deposit for property purchases after one year, but doesn’t mandate property investment. MM2H requires mandatory property purchases: Silver tier needs RM 600,000, Gold requires RM 1 million, Platinum demands RM 2 million, while SEZ requirements vary by state. All MM2H applicants must purchase property after approval. Harvey Law Group partners with trusted Malaysian real estate experts to help clients find suitable properties that meet program requirements.

Can I renew my PVIP or MM2H visa indefinitely in Malaysia?

Both PVIP and MM2H visas are renewable, offering potential long-term residency pathways. PVIP provides 20-year renewable terms with the most flexibility, while MM2H renewal periods depend on your tier (5-20 years). Successful renewal typically requires maintaining financial commitments and compliance with program requirements throughout your stay. Harvey Law Group’s ongoing support services include renewal assistance to maintain your Malaysian residency status seamlessly.

Should I choose PVIP or MM2H if I want to start a business in Malaysia?

PVIP is the clear choice for business ventures as it provides unrestricted work and business rights from day one. Only MM2H Platinum tier (USD 1 million investment) allows business activities, while Silver, Gold, and SEZ tiers prohibit business operations entirely. PVIP’s 20-year renewable term also provides the stability needed for long-term business planning and growth. Harvey Law Group’s business immigration attorneys specialize in helping entrepreneurs establish successful ventures in Malaysia through PVIP.

Ready to explore Malaysian residency options? Contact Harvey Law Group today for a personalized consultation. Our experienced immigration specialists will analyze your specific situation and recommend the optimal pathway – whether PVIP or MM2H – to achieve your Malaysian lifestyle and business goals.