The Swiss Lump Sum Taxation and Residency Program provides wealthy individuals a strategic opportunity to optimize personal wealth management through Switzerland’s robust financial system, while benefiting from the country’s exceptional living standards, education, services, and stunning landscapes.

What is the Swiss Lump Sum Taxation ?

Swiss Lump Sum Taxation is a Swiss preferential regime for high-net-worth foreigners that levies a fixed annual tax based on living expenses rather than worldwide income and assets, offering predictable fiscal advantages.

9 Reasons Switzerland is Ranked as the World’s Best Country

In the 2024 U.S. News Best Countries Ranking, Switzerland secured the top position, a reflection of its outstanding performance in economic influence, stability, innovation, quality of life, education, and sustainability. For international business owners and global investors, this ranking underscores a nation uniquely equipped to support both family prosperity and professional success. Here are nine key reasons behind Switzerland’s preeminence, revealing how each factor directly benefits those steering businesses and managing substantial investments.

1. High Living Standards

Switzerland holds 9th place on the 2024 Happiness Index, surpassing nations like Canada and New Zealand. For investors and business leaders, this signals more than content citizens—it reflects a stable, productive society with low systemic risk. Such stability is reinforced by OECD data: the country exceeds global averages in income, employment, education, health, environmental quality, safety, and life satisfaction. These metrics translate to a reliable workforce, robust consumer markets, and minimal operational disruptions.

Health underpins this equilibrium. Swiss life expectancy reaches 84 years, three above the OECD norm, reducing workforce attrition and healthcare liabilities. The universal healthcare system ranked first globally for innovation prioritizes prevention and patient-centric care, supported by three top-15 global hospitals. With 12% of GDP allocated to healthcare, Switzerland merges fiscal commitment with outcomes, offering opportunities in medtech, biopharma, and health infrastructure.

Economic resilience is further cemented by social cohesion. A homelessness rate of 0.02% (1 per 3,925 people) underscores systemic efficiency in welfare and urban policy, lowering crime and fostering secure environments for talent and enterprise.

For investors, Switzerland’s blend of human capital, innovation, and societal balance isn’t just appealing—it’s a blueprint for sustainable growth. The nation’s 9 million residents and compact 41,000 km² landmass exemplify how strategic governance and investment in public goods yield outsized returns. Here, prosperity isn’t an accident; it’s engineered.

2. Stable and Robust Economy

Switzerland’s economy shines as a beacon of stability and prosperity, making it a standout choice for business owners and investors. The Swiss government’s careful fiscal management keeps budgets balanced and public debt low, offering a secure foundation that high net worth individuals value when deciding where to invest. This prudent approach reduces financial risks and signals a dependable environment for long-term business growth.

The country’s economic freedom further enhances its appeal, ranking second worldwide and first in Europe in the 2024 Index of Economic Freedom, Switzerland boasts an efficient regulatory environment, a strong legal system, and minimal corruption. For investors, this translates to a predictable and fair playing field—crucial for planning and expanding operations with confidence.

In 2022, Switzerland’s GDP per capita hit USD 92,000, showcasing a wealthy population with strong purchasing power. This high income level supports a thriving market for goods and services, directly benefiting businesses targeting affluent consumers. The economy leans heavily on services, which generate 74% of GDP, while industry contributes 25%, and agriculture accounts for less than 1%. This modern, service-driven structure aligns perfectly with Switzerland’s role as a global financial hub, hosting multinational corporations and a robust banking sector that draw investments and create high-paying jobs.

Innovation also fuels Switzerland’s economic strength, particularly in pharmaceuticals. Companies like Novartis and Hoffmann-La Roche lead in drug discovery, biotechnology, and medical advancements, highlighting a commitment to high-tech industries.

Employment figures tell a similar story of economic health. About 80% of people aged 15 to 64 hold paid jobs, far exceeding the OECD average of 66%. With an unemployment rate of just 2.2% in 2022, Switzerland offers a skilled and reliable workforce—a key asset for investors launching or scaling operations.

Switzerland offers an attractive fiscal environment for businesses. The standard VAT rate is 8.1%, with reduced rates of 3.8% for accommodation services and 2.6% for everyday items, measures that help lower costs in key sectors. Additionally, Switzerland’s corporate tax advantages make it a preferred location for global or European headquarters. Combined with a deep talent pool, a high quality of life, and a prime central location, these factors reinforce Switzerland’s appeal as a destination for businesses.

3. Political Stability

Switzerland is renowned for exceptional political stability, a factor that inspires high levels of confidence among business owners and investors. The country’s extremely low corruption rates add a layer of transparency and trustworthiness to its political environment. For over 200 years, Switzerland has maintained a policy of neutrality, steering clear of conflicts and wars, which in turn heightens investors’ sense of security. As a federal state with 26 cantons, it allows each region significant autonomy, enabling tailored governance at the local level while contributing to the unified stability of the nation.

4. Unparalleled Natural Beauty

Switzerland is famous for its stunning landscapes. The country is home to some of the most famous mountains in the world in the Swiss Alps, breathtaking glaciers, and renowned world class ski resorts such as Zermatt, St. Moritz and Verbier.

Other than skiing, hiking and mountaineering, residents are also able to enjoy world class water-based activities such as sailing, fishing, kayaking, windsurfing and more, at magnificent lakes such as Lake Geneva (one of the largest lakes in Europe), Lake Lucerne, and many others.

Serene green valleys and spectacular waterfalls, as well as charming traditional villages, help complete the picture-perfect scenery that Switzerland has to offer.

Switzerland can provide for all, whether nature lovers, adventure seekers, athletes, or persons simply looking for tranquillity.

5. Excellent Education and Innovation

Switzerland’s education system and innovation ecosystem form an unrivaled foundation for sustained economic success. Public education is free or highly subsidized, and quality remains exceptional at every level. In fact, 89% of adults aged 25–64 have completed upper secondary education, compared to the OECD average of 79%. Students in Switzerland score an average of 498 in reading literacy, maths, and science on the OECD’s PISA assessment, surpassing the OECD average of 488.

Switzerland’s advanced higher education system reinforces its global competitiveness. Top-tier institutions such as ETH Zurich (#21), the Swiss Federal Institute of Technology Lausanne (#55), the University of Geneva (#58), the University of Zurich (#67), and the University of Basel (#95) produce highly skilled graduates and groundbreaking research. This strong educational framework is crucial to Switzerland’s status as a global innovation leader, particularly in pharmaceuticals, engineering, and technology.

Switzerland has held the #1 rank among 133 economies in the 2024 Global Innovation Index for over five years. This leadership is driven by a sustained emphasis on research and development, world-class educational institutions, and a business-friendly environment that fosters creativity and collaboration. The Swiss government backs these efforts with targeted funding, grants, and tax incentives for R&D initiatives, spending approximately CHF 23 billion each year—roughly 3% of GDP—with the private sector contributing over two-thirds of this investment. Agencies like the Swiss National Science Foundation and Innosuisse support innovative projects and help startups and SMEs bring new ideas to market.

Switzerland’s startup ecosystem thrives in sectors such as fintech, biotech, and cleantech. Entrepreneurs benefit from access to funding, mentorship, and incubators like Swissnex, an initiative of the State Secretariat for Education, Research and Innovation—and Venturelab. The Swiss city of Zug, known as Crypto Valley, exemplifies the nation’s innovative spirit. Global companies such as Bitcoin Suisse and Ethereum have roots in this vibrant hub, where over 600 companies employing more than 3,000 people operate. Zug continues to attract new blockchain companies and ranks fourth in the 2023 Crypto Hubs Ranking due to clear regulations, a favorable taxation system, crypto-friendly banking institutions, and a dynamic job market.

6. Multiculturalism Richness and Multilingualism

Switzerland stands out as a multicultural society that enriches its economy, society, and culture. The country has four official languages—German spoken by 62% of the population, French by 23%, Italian by 8%, and Romansh by 1%, a structure that naturally fosters bilingualism or trilingualism among its residents. Swiss schools emphasize multilingual education from an early age, ensuring that children gain essential language skills that complement the nation’s rich cultural mosaic.

Distinct regions in Switzerland preserve unique cultural traditions and diverse culinary practices, continuously enhancing the nation’s identity. The country’s vibrant arts scene is further bolstered by globally recognized events like the Montreux Jazz Festival and Locarno Film Festival, which draw artists and audiences from around the world. With around 25% of its population being foreign-born, Swiss cities have evolved into hubs for internationally educated professionals. These urban centers also benefit from hosting influential global organizations such as the United Nations, World Health Organization, International Red Cross, and the World Economic Forum in Davos, alongside numerous multinational corporations and financial institutions, all of which reinforce Switzerland’s appeal as a premier destination for business and investment.

7. Safety

Switzerland is one of the safest countries in the world. Its crime rates are very low, creating a secure environment for business and investment. A strong rule of law governs all aspects of society, ensuring predictability and trust. Switzerland ranks #6 out of 163 countries on the 2024 Global Peace Index, reflecting its overall stability and commitment to public safety.

8. Engagement Towards Environmental Sustainability

Switzerland has established itself as a global leader in environmental protection by implementing strict policies on waste management, renewable energy, and conservation. The country ranks #9 out of 180 on the 2024 Environmental Performance Index, a recognition driven by exceptional environmental health, sustainability, water sanitation, and water resources management. Its proactive stance is further demonstrated by Switzerland’s status as one of the top recyclers in the world and its strong embrace of renewable energy.

The Swiss Federal Railways (SBB), the largest transportation company in the country, relies exclusively on electric trains, with 90% of its trains powered by hydropower as of 2023. This commitment to clean energy contributes to Switzerland’s atmospheric PM2.5 level of 10.1 micrograms per cubic meter, notably below the OECD average of 14 micrograms per cubic meter. Water quality is similarly prioritized, with 96% satisfaction among residents compared to an 84% OECD average.

Switzerland is actively transitioning its energy sector with a clear target for climate neutrality by 2050. The country has scaled back its nuclear power, operating only 4 of its 5 nuclear plants since 2020, while renewable sources already account for 28% of its total final energy consumption as of 2021. Looking ahead, increased adoption of renewable energies is expected, driven by communication campaigns, financial incentives, and support for innovation. Highlighting this innovative momentum, Switzerland developed the world’s first high-altitude floating solar farm on Lac Des Toules at 1,810 meters above sea level.

9. Financial Privacy

Swiss banks have built a reputation as a secure haven for wealthy individuals worldwide. Banking privacy in Switzerland was formally established in 1934 through the Swiss Banking Act, which makes it a criminal offense for banks to disclose client information without consent. This legal protection offers robust confidentiality that appeals to high-net-worth investors and business owners seeking safe financial environments.

Switzerland’s commitment to privacy is further demonstrated by its ranking as second among 141 countries on the 2022 Financial Secrecy Index, as reported by the Tax Justice Network. Since 2017, the country has also embraced the Automatic Exchange of Information and Common Reporting Standard with over 100 nations, creating an international framework for sharing financial details between tax authorities to increase transparency and prevent tax evasion.

Nonetheless, Swiss banking secrecy is not absolute; it may be lifted in instances of suspected money laundering or when information is required by foreign administrations to assist in tax evasion matters. This balance of rigorous privacy and strategic transparency forms the backbone of Switzerland’s appeal as the best country in the world for financial privacy.

Swiss Banking Secrecy and Financial Privacy

Swiss Banking Secrecy and Financial Privacy are long standing legal protections that safeguard client information in Swiss banking, established by the Swiss Banking Act of 1934 and moderated by modern transparency standards.

Benefits of Switzerland Residency: At the Heart of Europe

Switzerland occupies a special place at the heart of Europe, offering unique advantages for business owners and investors. Home to nearly 9 million people, Switzerland stands as a major European cultural and economic center. Its strategic location in Central Europe, bordered by France, Germany, Italy, Austria, and Liechtenstein, facilitates trade and economic cooperation with neighboring countries. For those looking to establish a strong headquarters for their business and investment ventures, Switzerland’s position and strengths are hard to overlook.

Travel

Switzerland’s modern and well-developed public transportation networks make getting around simple and efficient. Buses, trams, and trains run frequently, connecting every corner of the country. Beyond its borders, Switzerland is easily accessible from many European countries through its excellent train and bus systems. The country also hosts three international airports, Zurich, Geneva, and Basel along with several regional airports. Flying to Geneva from cities like London, Paris, Madrid, Rome, or Berlin takes under two hours, keeping businesses close to key markets and partners.

Residency Opens Doors

Swiss residency provides a visa exemption for traveling within the Schengen Area, which includes 27 countries such as Austria, Belgium, France, Germany, Italy, and Spain. Residents can stay in any of these nations for up to 90 days within any 180-day period without needing a visa. This freedom of movement is critical for business owners and investors who need to meet clients, explore opportunities, or manage operations across Europe.

Schengen Area

The Schengen Area is a zone of 27 European countries that have abolished internal border controls, enabling passport-free travel for up to 90 days within any 180-day period and facilitating business and leisure travel.

A Path to Stability

Obtaining a residency permit in Switzerland allows an individual and dependents to work toward a settlement permit, also known as permanent residency, or even Swiss citizenship if desired. Generally, an individual must live in Switzerland for at least 10 years before applying for a settlement permit. However, nationals from countries like Germany, Austria, France, the USA, or Canada may qualify for a fast-track route after just five years. Once granted, this permit lets the person conduct paid work in Switzerland.

Swiss Residency Permit

A Residency Permit is a legal authorization granted by Swiss authorities that permits an individual and dependents to reside in Switzerland, with rights varying by nationality and serving as a prerequisite for regimes like the Swiss lump sum taxation.

Swiss Settlement Permit (Permanent Residency)

A Settlement Permit, also known as Permanent Residency, is a long-term status awarded after a prescribed residence period, typically 10 years or 5 years for eligible nationals that offers stability, reduced renewals, and a path to Swiss citizenship.

Requirements That Matter

Securing a settlement permit comes with clear expectations. The applicant needs basic skills in one of Switzerland’s official languages, German, French, Italian, or Romansh. With an A1 level in writing and A2 to B1 in speaking. Showing sufficient integration into Swiss society, economic independence, and a clean criminal record are also required.

Keeping The Settlement Permit Status

The settlement permit remains valid as long as the applicant stays connected to Switzerland. Spending six months or more overseas without authorization from Swiss authorities can put it at risk. If the person needs to be away for an extended period, informing local authorities can help maintain the permit for up to four years with proper approval. This flexibility is key for investors with global interests.

Citizenship as a Goal

For those aiming to fully integrate, Swiss citizenship is within reach through ordinary naturalization. An individual must hold a settlement permit and have lived in Switzerland for at least 10 years. Successful integration, familiarity with the Swiss way of life, and posing no threat to the country’s security are essential. Cantons and communes handle citizenship procedures and may add their own requirements, so local rules matter. Once achieved, the citizenship status lets the individual move out of Switzerland and return without restrictions.

Tax and Freedom Trade-Offs

Citizenship comes with a shift in responsibilities. Lump sum taxation, a benefit for wealthy foreigners, isn’t available to Swiss citizens. This calls for careful analysis of whether staying on a settlement permit or pursuing nationality suits the person’s financial strategy. For those who become citizens, the EU-Switzerland agreement on the free movement of persons adds value, allowing the person to live and work in any EU country. This opens up even more possibilities for cross-border business and investments.

For business owners and investors, Switzerland’s lump sum taxation regime offers a rare combination of tax predictability, wealth preservation, and strategic flexibility. While the Swiss tax system is famously complex, shaped by federal, cantonal, and municipal laws the Swiss lump sum mechanism simplifies liabilities for qualifying foreign nationals. Here’s why it matters.

Why the Lump Sum Regime Attracts Global Investors

Switzerland’s federal structure allows cantons like Zug to set corporate tax rates as low as 11.80%, among the lowest globally. For individuals, Zug’s progressive income tax starts at 11.93% on the first CHF 100,000. But high-net-worth foreign residents can bypass income-based calculations entirely under the lump sum regime. Instead, taxes are negotiated upfront with local authorities, based on annual living expenses rather than worldwide income or assets. This provides certainty: liabilities are fixed, unaffected by fluctuations in overseas earnings or investments.

The financial advantages are clear. Switzerland imposes no capital gains tax on privately held shares or securities, preserving wealth growth. Meanwhile, the lump sum system shields foreign income, dividends, royalties, business profits from Swiss taxation. For investors with substantial international assets, this translates to significant savings, especially compared to jurisdictions taxing global income.

Historical stability reinforces the regime’s appeal. Established in 1862 and formalized into federal law by 1990, the system has survived political challenges, including a 2014 referendum where 60% of voters rejected its abolition. Though five cantons have discontinued lump sum taxation, 21 retain it, reflecting Switzerland’s pragmatic approach to attracting global capital.

For business owners, the lump sum regime complements Switzerland’s corporate tax efficiency. By aligning residency here, investors gain dual benefits: optimized personal tax exposure and proximity to a low-tax corporate environment. The result is a streamlined, strategic foothold in one of the world’s most stable economies, without compromising global financial interests.

Calculations in Practice: The Lump-Sum Taxation

Whilst reading this section, please bear in mind that the online tax estimation tools available to the public, when taking a minimum tax base of CHF 434,700, result in any estimated tax of CHF 90,000 in Zug, or CFH 165,000 in Geneva, regardless of the amount of foreign income.

Tax Base

Tax Base in lump sum taxation is a predetermined annual figure representing living expenses in Switzerland used by authorities to calculate a fixed tax liability, independent of global income fluctuations.

Switzerland is also renowned for tax efficiency and financial privacy. The Swiss Lump Sum Taxation regime aligns with these principles, as it does not require detailed disclosure of worldwide income and assets.

The amount of lump sum tax is to be agreed with the local tax authorities in advance. Cantons enjoy a certain level of autonomy, but the general rules are set out below to give an understanding of the mechanics.

Before applying the relevant ordinary tax rates (which will depend on canton and municipality – for instance, we note that marginal tax rates may vary from 22% to 45% or so) to the taxable base, the taxable base will need to be established.

The tax base is assessed based on the amount of annual living expenditures, and must not fall below the minimum levels set by federal and cantonal legislation:

- CHF 434,700;

- 7 times the annual rent of the applicant’s principal residence in Switzerland (if renting);

- 7 times the annual rental value of the applicant’s principal residence in Switzerland if the applicant owns his place of residence; or

- The family’s annual (worldwide) living expenses.

The amount of the tax base should be agreed with the canton’s tax authorities. The following is usually considered as part of the personal living expenditures to be taken into account when establishing the tax base:

- Housing

- Personal staff

- Education

- Leisure and culture

- Healthcare

- Food and clothing

- Travelling and vacation

- Costs of vehicles (e.g. cars, boats, planes etc)

- Costs of animals (e.g. horses)

- Foreign tax

- Other costs

In addition to the above, note that the tax base will need to be at least as high as the sum of Swiss-sourced income (if any) (covering Swiss-source income including income derived from property or other assets located in Switzerland, Swiss intellectual property and Swiss pensions). Foreign-sourced income for which benefits from Swiss double tax treaties were requested would also be included in the tax base. This is called the ‘Control calculation’. If the income under the amount of tax calculated on expenditure and the amount resulting from the control calculation do not combine, only the higher of the two amounts is due.

Note that double tax treaties concluded between Switzerland and other countries could also affect the amount of the tax base, notably with countries that require to include the income from those countries in the Swiss tax base to benefit from the double tax treaty (for instance Austria, Belgium, Canada, France, Germany, Italy, Norway and the United States).

Double Tax Treaty

A Double Tax Treaty is an agreement between Switzerland and other countries that prevents the same income from being taxed twice, ensuring fair tax practices and reducing risks of double taxation.

Ultimately, the tax amount would be the result of negotiations with and subject to a tax ruling of the canton’s tax authorities.

Who is Eligible for Switzerland’s Lump Sum Taxation and Residency Program?

Eligibility Requirements

The main applicant must be at least 18 years old. Married spouses and unmarried children under 18 may be included. Switzerland imposes no education prerequisites or language tests on the primary applicant, streamlining the process. However, dependents applying for family reunification must demonstrate A1-level oral proficiency in a national language or enroll in a language course. All applicants must provide clean criminal records. The eligibility details are outlined here.

Program Restrictions

Swiss nationals and individuals who held Swiss tax residency within the past 10 years are ineligible. Approved applicants and dependents must physically reside in their chosen canton for over six months annually. The permit prohibits paid employment within Switzerland, restricting holders to non-labor income sources such as investments or overseas business activities.

Considerations

The 10-year tax residency rule targets applicants without recent ties to Switzerland. The six-month physical stay requirement demands careful planning for globally mobile individuals. While dependents face minimal language hurdles, proactive enrollment in courses may streamline reunification.

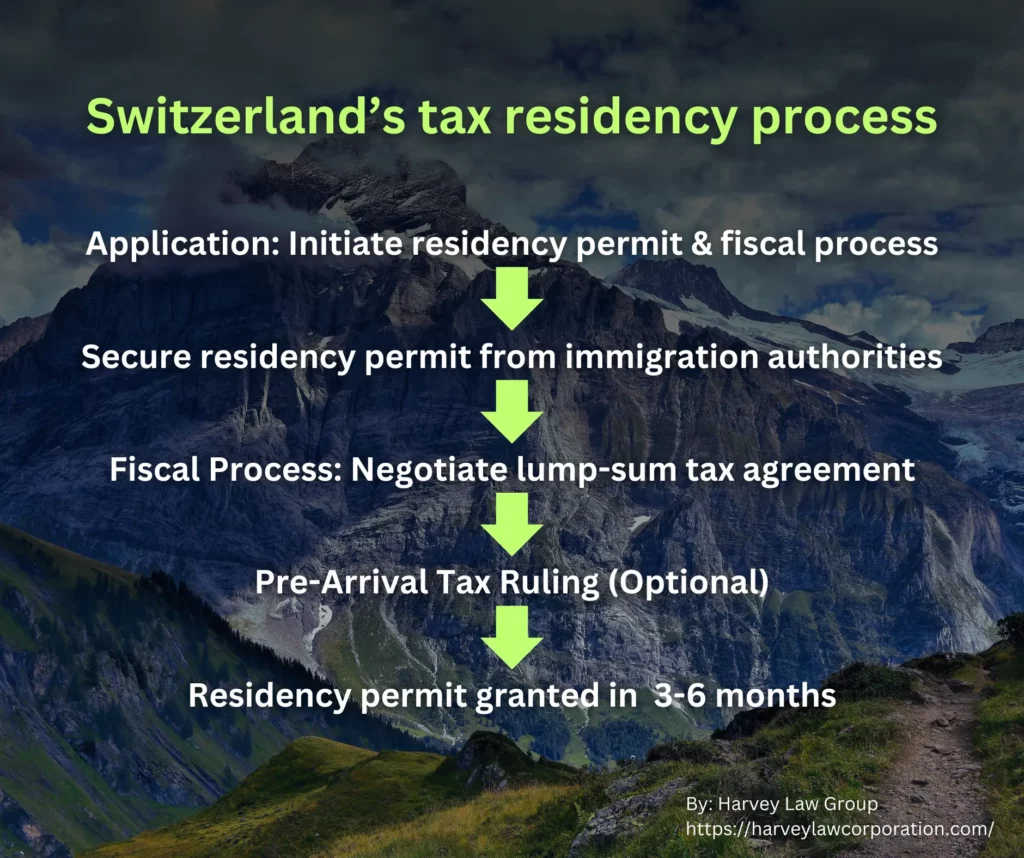

The Process: From Application to Approval

Switzerland’s tax residency process offers high net worth individuals a structured path to fiscal clarity and residency security. The system operates in two distinct phases: residency and fiscal. Both require coordination with local authorities, typically concluding within 3–6 months. Here’s what matters most to business owners and investors.

Residency and Fiscal Processes

The residency component involves securing a permit, which immigration authorities may issue before arrival. Simultaneously, the fiscal process negotiates a lump-sum tax agreement with cantonal tax authorities—a fixed annual amount based on lifestyle expenses rather than global income. This arrangement is conditional on obtaining the residency permit, though pre-arrival tax rulings provide upfront certainty. Some cantons may require physical presence during the process, but this is case-specific.

Timeline and Family Considerations

The 3–6 month timeline hinges on efficiency in documentation and negotiations. Family reunification applications run parallel to the main applicant’s process, managed by the same authorities. For EU nationals, this includes children from prior relationships (with consent), while non-EU dependents face discretionary assessments. Visa-required nationals begin family applications at Swiss embassies, though approval depends on the main applicant’s success.

Permit Validity and Renewals

EU nationals, alongside those from Iceland, Liechtenstein, and Norway receive 5-year renewable permits in Switzerland, reflecting the alignment with EU mobility standards. Non-EU nationals receive 1-year permits, renewable annually, subject to ongoing compliance.

Cantonal Autonomy

Switzerland’s 26 cantons set their own tax rates, residency criteria, and lump-sum thresholds. This decentralization means strategies must be tailored to specific regions. What works in Zurich may not apply in Geneva.

Cantonal Autonomy

Cantonal Autonomy is Switzerland’s decentralized system in which each canton sets its own policies, including tax rates, residency criteria, and lump sum thresholds.

Final Note

While the framework of Switzerland’s Lump Sum Tax and Residency Program is standardized, outcomes depend on individual circumstances. Engage advisors early to navigate cantonal nuances and ensure alignment with personal and financial goals. Switzerland’s blend of predictability and flexibility makes it a compelling choice, provided stakeholders respect its decentralized, case-by-case nature.

Laure Cochet

Harvey Law Group